Introduction

saveDAI aims to be the easiest way to open a high-interest, insured savings account.

The idea for saveDAI dates back to late summer 2019 when I realized that I wanted to see a tokenized version of Nexus Mutual contract cover for cDAI (“nmcDAI”). However, it soon became clear that the architecture of Nexus Mutual did not lend itself to tokenization. Fast forward to when Opyn protocol launched tokenized option-based insurance for cDAI and cUSDC just before ETHDenver, and I changed my planned hackathon project to what would become saveDAI.

Our team is Kseniya (a member of Meta Delta Gamma), Doug, and me (Spencer).

So what is saveDAI? Well, it’s two things:

1. A smart contract / primitive

A smart contract that wraps together an equivalent amount of cDAI and ocDAI to create what we call a “self-insured asset”. The contract has functionality to wrap, unwrap, and submit an insurance claim (i.e. exercise the ocDAI for immediate payout).

The contract will be open-source and available as an on-chain primitive for others to build on or integrate with. For example, protocols that automatically deposit DAI held in their contracts into Compound could instead deposit DAI into saveDAI to easily insure their assets.

This proposal is for saveDAI 1.0. See below for a potential 2.0 direction.

2. A user-facing product

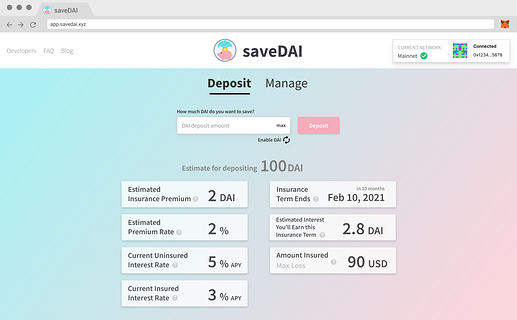

A user-facing dapp powered by the contract that makes it super simple for users (we call them “savers”) to open a savings account.

saveDAI is almost entirely a user experience project. It’s already possible to acquire both cDAI and ocDAI, but the multiple steps involved limits the number of people who have done so thus far. There are fewer than 50 addresses with ocDAI balances today. We believe that by removing a significant portion of the friction involved, we can attract more savers to protect their savings.

More savers protecting their savings benefits multiple parties:

- the individual savers, whose savings are now protected against most risks

- sellers and buyers of ocDAI, who will see greater liquidity

- the DeFi ecosystem, which will have a greater portion of its activity protected by insurance

In fact, we also believe that saveDAI could help onboard more muggles into crypto by creating an easy way for them to open a savings account that closely mirrors their traditional account (deposit insurance is the key), but with higher interest and without the various hassles of dealing with a bank.

To this end, in addition to the natural UX improvements that the saveDAI contract achieves, we also plan to incorporate gas payment and fiat-onboarding tools — e.g. from Authereum and Wyre — into the subsequent iterations of the product.

saveDAI is primarily a UX project, but, for obvious reasons, saveDAI makes no sense unless it can properly protect our users’ funds. Therefore, while the saveDAI contract limits bug/attack surface area by creating minimal net new functionality — instead bundling together and exposing the functionality already built by other projects — it is imperative that the contract code be professionally audited. This proposal’s primary ask is for funds to pay for an audit.

Sustainability and public goods status

Since the saveDAI contract draws nearly all of its functionality from existing protocols like Compound, Opyn, MakerDAO, and Uniswap (hooray money legos!  ) and does not generate a first-order (e.g. liquidity) network effect, it does not have a defensible business model of its own.

) and does not generate a first-order (e.g. liquidity) network effect, it does not have a defensible business model of its own.

For example, forking the contract would be trivial and would not diminish its utility at all. Similarly, while a well-built user-facing product could garner a significant user-base, any revenue opportunity would need to be based on up-sell or add-on features, and a number of well-built products and well-funded companies already exist that could likely adopt saveDAI-like capabilities (or, frankly, saveDAI itself) relatively easily — think Instadapp, Zerion, Argent, Dharma, and the like.

Therefore, we view saveDAI as a free and open-source public good.

Read more here:

- Our twitter: @save_DAI

- Our introductory blog posts

Mission and vision

- Bring more security to DeFi savings by removing friction from the process of buying insurance

- Onboard new users into Ethereum by creating an easier way to open an insured, high-interest savings account (i.e. strictly better than a traditional savings account)

- Build a way to easily create self-insured assets (see below)

Progress

saveDAI is currently a side-project for everybody on the team. Here is what we have accomplished to date:

- Cultivated a highly-interested following on twitter — pre-launch, @save_dai currently has 729 followers

- Completed the 1.0 smart contract — currently wrapping up documentation

- Completed design for the desktop web dapp UI, informed by user tests and interviews — currently working on a mobile web design

We are aiming to release saveDAI 1.0 in June 2020, though the timing of our launch may change depending on the interest rate environment.

What else can we achieve?

Options-based insurance from Opyn has several properties that make saveDAI possible:

- It’s permissionless, which allows saveDAI to incorporate it with no restrictions and savers to acquire saveDAI without a KYC requirement

- It’s tokenized, which allows saveDAI to bundle it together with the asset it insures

- It’s sold on uniswap, so there will always be a market for it

However, the current version of ocDAI is just that — a current version. The insurance it provides expires when the option series expires on February 10, 2021. After that date, saveDAI will need to transition to the next option series.

Moreover, we anticipate a proliferation of variations of ocDAI (differing on strike price as well as expiry date), and there are already different assets covered in addition to cDAI, like cUSDC and iearn tokens.

That presents a challenge for saveDAI, since new contracts will need to be developed and deployed to handle the transition to new terms or cover additional insurance variations.

saveDAI 2.0: A self-insured asset factory

But it also presents an opportunity: what if there were an easy way to create a new token for any asset:insurance combination you needed?

We envision a self-insured asset factory that allows anybody to create new tokenized bundles of a given asset together with its insurance.

Such a factory would enable the saveDAI dapp to…

- greatly simplify for savers the process of rolling over to the next insurance term,

- allow savers to select the level of insurance they prefer (e.g. covering a lower portion of their savings at a cheaper premium), or even

- allow savers to use non-DAI assets for their savings, e.g. USDC, iEarn, RAY, aDAI, a stablecoin token Set, etc.

Eventually, if a tokenized insurance standard is adopted, the factory could even support other types of insurance in addition to Opyn options.

Use of funds

Thus far, other than the time we have put into the project, we have spent only a total of $11.18 on saveDAI — $1.18 for the savedai.xyz domain name and 10 DAI on the savedai Everest listing.

This proposal for saveDAI 1.0 asks for $7,750, which will be used in the following fashion:

- $4,750 for an audit on the saveDAI 1.0 contract, to be conducted by Quantstamp

- $3,000 to complete the 1.0 dapp front-end

If the user-facing dapp achieves sufficient traction, we may submit a follow-up proposal to develop the 2.0 contract(s) required to expand to additional savings assets.