Hey MetaCartel! Been following you guys for a while and excited to finally be posting a proposal!

Sherlock

A Better Alternative to DeFi Insurance

Mission

Sherlock’s goal is to bring DeFi to mass adoption. One of the biggest blockers we see is the security of DeFi. Audits are great but they aren’t 100% effective. Existing insurance is missing the mark and covers less than 3% of TVL in DeFi. Sherlock has a novel approach that we’ve already gotten a ton of validation for.

Problem

Existing insurance fails mainly on two fronts: affordability and user experience.

Solution

Sherlock makes insurance affordable by selling wholesale to protocols and integrating an internal team of smart contract security experts to accurately price insurance in DeFi (something that is sorely missing). And Sherlock makes the user experience easy by working with protocols to insure their TVL so users never need to worry about insurance – they are always covered.

Protocol Design

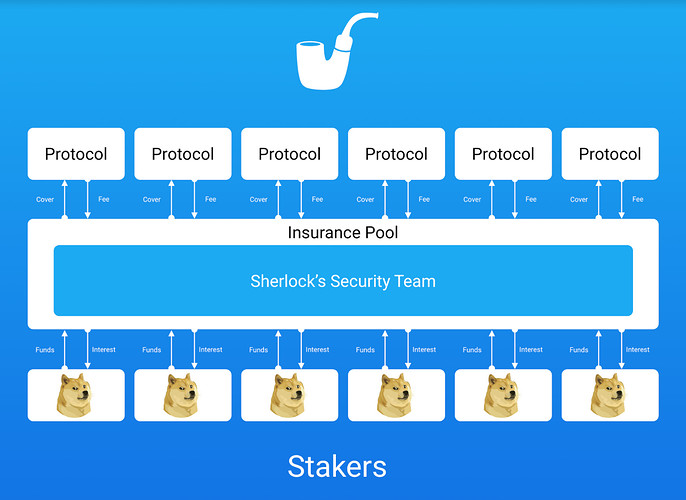

At the heart of the protocol, there’s a pool of tokens that’s set aside to reimburse hacks for any of the protocols we cover. There are 3 main parties who interact with the pool:

Protocols

Protocols pay a small fee in exchange for full coverage against hacks. The fee is decided by our team of security experts who conduct diligence on the protocol and decide on a fair price.

Stakers

Stakers put tokens into the insurance pool in exchange for one of the highest yields in DeFi. Protocols fees go into the pool and contribute to the yield for stakers. In the event of a hack, funds contributed by stakers reimburse the users of the hacked protocol.

Security Team

Our internal security team does research on protocols who want coverage and gives them a price for that coverage. The team’s compensation is based on the return to stakers. If stakers get more fees from protocols, the team’s compensation will be higher. If stakers pay out significant amounts for hacks, the team’s compensation will be lower.

Progress

Sherlock was created in the MarketMake hackathon in February. You can see our project here. We’ve since re-branded to Sherlock – would link but Discourse won’t let me post more than two links  and are working on a mainnet launch which we see coming in 6-8 weeks (including audits).

and are working on a mainnet launch which we see coming in 6-8 weeks (including audits).

Traction

We’ve gotten really great responses from customers and are working super closely with Badger DAO ($1.5Bn TVL) to be one of our first customers when we launch. Other customers on our waitlist include Matic/Polygon, PieDAO and Superfluid.

Team

Jack Sanford (full-time): Biz Dev / Full-stack (jack__sanford on twitter)

Evert Kors (full-time): Backend / Smart Contracts (Evert0x on twitter)

Ask

5000 DAI to get Sherlock to mainnet.

Since we’re building out an internal smart contract security team, we think we can get massive discounts on audits (or free ones hopefully), so we need funding to bridge our frontend guy so he can leave his job as well as for deploying contracts to mainnet.

Plan

We have finished the protocol design (can share that with you guys soon) and we’re translating it into Solidity which should take about 3 weeks. Our frontend is on a similar timeline and we think we can get audits done over the course of the following 2 weeks. Our goal is to get 5 protocols covered with our insurance and we think we can hit that in the next 3 months.

Check us out on Twitter for more info (pinned) about our protocol as well as for updates! And feel free to reach me at jsanford9292 on Telegram. Looking forward to your feedback!