Proposal

NFTcol is a lending protocol that uses NFTs as collateral. The problem with using NFTs as collateral has always been the fact that their value is not easily determined, so we would not know when to liquidate the collateral.

Let’s take a look at similar projects:

-

NFTfi and stater use a peer-to-peer model that connects each borrower to a lender. This approach works awfully slow as the borrower needs to wait for a lender to show up.

-

Rocket NFT only provides under-collateralized loans. The Problem is that there can be no trust when the loan is under-collateralized. So, rocket NFT gives loans based on borrowers’ proposals. They get some information like the borrower’s income and the incentive to get the loan. This approach brings up two issues: the anonymity of the borrower is questioned and the proposal acceptance takes time.

How do we solve these problems?

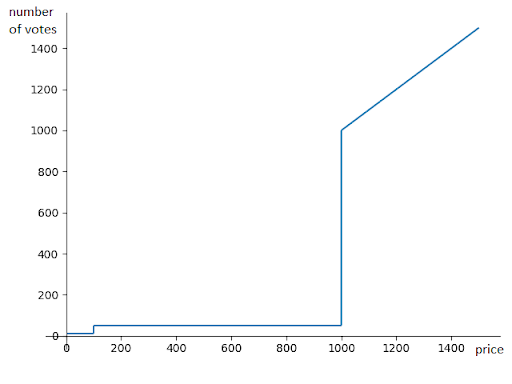

In NFTcol, we use the society vote to determine the value of NFTs. All members have the right to vote to determine the price of NFTs. These NFTs can be used as collateral to get loans. Using this strategy, the problem of NFT pricing gets solved by using the ultimate purpose of blockchains which is decentralization itself! Moreover, to prevent attacks, the number of required votes increases with the price.

In fungible-token-based lending protocols like maker, there are liquidity pools that provide the loan amount in real-time without needing to wait for a lender. In NFTcol we use the same approach. Willing investors will provide liquidity to the liquidity pool and they will receive fees on every taken loan. If the value of the collateral drops off the collateralization ratio (when users change their votes to a lower amount), it will get liquidated in an auction. The borrower has to pay a fee for every day that they are holding the loan.

In NFTcol, in contradiction to NFTfi, stater and rocket NFT, as soon as the voting for the price is over, the loan can be given in real-time. Users, regardless of whether they are willing to get loans or not, can have their NFT’s price determined by the community. As soon as the price is determined, the user can decide to take a loan on the NFT, which would be in real-time.

How do we avoid attacks?

Number of votes that are required to determine an NFT’s price increases in proportion to its price. The relation between price and required votes is shown in the figure below. Due to the future changes, this relation can change.

We are looking forward to receiving a grant of $3000 to help the initial development of the NFTcol. Thank you.