We are RADE.

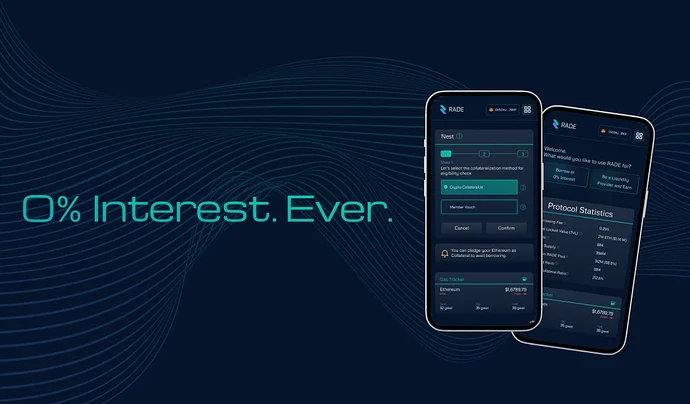

RADE is an interest free DeFi lending and borrowing protocol which offers both over-collateralized and under-collateralized borrowing.

Problem 1 : Today, users have to overcollateralized their assets in order to secure a loan. This is generally a problem with people in dire need of loans. They do not usually have large asset deposits to collateralize their borrowing requirements.

Problem 2 : Compounding interests leading to debt burden: Today, when users keep repaying the borrowed loans in interest-only payments, the repayment can last years and might end up in having to payback many folds the initial capital borrowed.

Solution 1 : An identified opportunity for under-collateralized loans led us to develop a DeFi platform called RADE, which offers a unique feature called MemberVouch. It works on a micro-financing model. A user can be part of a cohort which encourages its members to deposit a small amount of their choosing to the pool as a savings account. A member can borrow from their cohort upto the total sum of the combined values of deposits of all the members in their respective cohort. The amount borrowed must be less than the deposits of the members vouching for the borrower. When the member repays, the vouched members get a share of the profit distributed by the platform. Use-case: Friends borrowing from each other, family members who want to give and lend money without getting into other legal contracts.

Solution 2 : RADE is built on the philosophy of creating a dependable and user-centric financial solution that take back control from interest-bearing predatory systems. RADE provides both over-collateralised and under-collateralised borrowing at 0% interest and users can build confidence Index (CI) which acts like credit score which enables them to avail further financial services from the platform and other associated strategic partners.We offer an interest-free cost-plus financing model where by the repayment is against a borrowed capital plus a platform fee. There is no interest portion of the lending transaction and thereby does not influence a compounding portion to indefinitely repay. the user can only repay against the total borrowed capital and the fee that the platform charges, which will in turn, be partly distributed to the liquidity providers.

Progress : Alpha on Goerli Testnet.

Differentiation : Within the DeFi space, one of the central and default concept is over-collateralized. Under-collateralized borrowing holds huge potential as in novelty and usability. However, under-collateralization requires credit scoring and other vetting mechanisms to evaluate the user before providing financial services. Building a robust crypto based credit scoring hold huge potential. It also has significant other challenges in presenting the use-case of friends and family lending circles and bringing them on-chain. If we are able to successfully tackle these challenges, this is going to create significant disruptions in the space. Moreover, our core philosophy is ethical finance. Our pursuit is to build dependable and user-centric financial solutions that take back control from interest-bearing predatory systems. This, not only has huge potential from an end-user perspective, the ethical and sustainable factor creates a better world for everybody alike.

Grant Proposal : $10,000

Fund Usage : Primarily to setup paid infra subscriptions and guerrilla marketing to get some steam for product and launch in main net.

Links :

website → www.rariti.io

Docs → https://docs-rade.rariti.io/

Medium → https://medium.com/@rade_io/0-interest-ever-7218380ac66f

Discord → https://discord.com/invite/QjPXwpCUA2

Twitter → https://twitter.com/rariti_io