Thanks so much everyone for having us on yesterday’s call! It was awesome to be able to share with MetaCartel all the progress that meTokens has been making. For anyone who was not on the call, feel free to drop your questions below in the thread and I’ll be sure to answer them as quickly as possible.

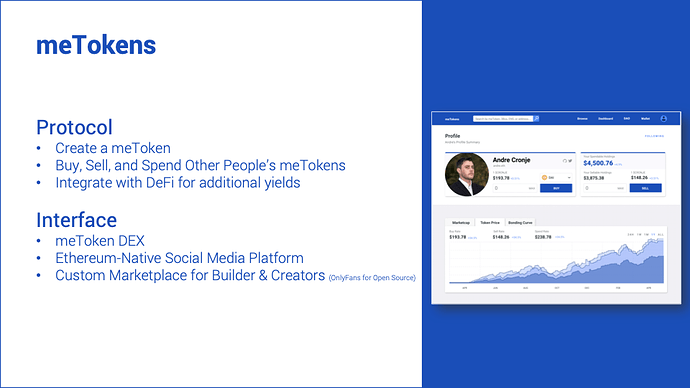

meTokens

An automated market maker to create, secure, and exchange personal tokens

Problem

It is easier to predict who will be a successful person than it is to predict what will be a successful product or company (Source: Naval). Unfortunately, there is no way to invest in people directly even though they are the source of all value creation.

Solution

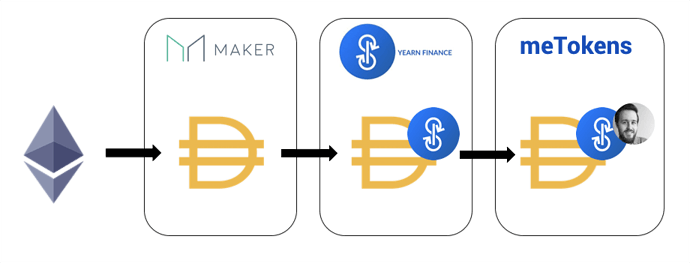

Economically sound personal tokens. Investors should be rewarded for staking money on a person early on if, later, they become more productive or popular.

Conversely, people who are staked upon should experience an acceleration in the rate of their attainment of success as a direct result of their token holders’ involvement.

Overview

Product

- Create your own meToken

- Invest in others’ meTokens

- Spend your portfolio of meTokens with their issuers on goods and services

- Redeem your meTokens for their underlying collateral

- Know that everything is economically secure

Progress

meTokens launched an alpha version of the protocol on mainnet in April 2020 as the first official project to come out of the Raid Guild. The initial deployment operated as a proof-of-concept to validate the hypothesis that collateralized personal tokens, issued by a novel “discount” AMM, could feasibly operate on-chain. The experimental design proved functional and garnered a loyal initial user-base.

While technically functional, the alpha revealed a significant number of opportunities for improvements, including:

- Vault-AMM partitioning - coincidentally, an innovation also converged upon simultaneously in Balancer V2’s upcoming release

- Dynamic bonding curves - a new AMM primitive which dramatically expands upon Billy Rennekamp’s original proposal from 2018

- Governance & liquidity mining - meTokens was originally designed to avoid governance at all costs in favor of pure self-sovereignty. However, since Apr 2020, enough experiments have taken place throughout DeFi to recognize the increased efficiency and coordination that can take place when a governance token is incentivized and distributed correctly without compromising user security

Each of these innovations has been rolled into a completely new version of meTokens, which is currently in the final stages of development, along with a brand new, more content rich, social dapp platform. All of which will be made open source upon release.

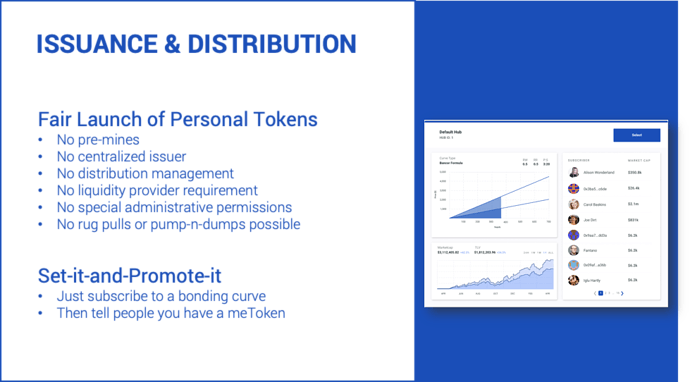

Differentiation

meTokens are critically different from any other personal token design because their supply and distribution is managed entirely by a custom built AMM, not a centralized issuer. The AMM ensures that all meTokens are properly collateralized with real underlying value, and that this value is predictably skewed in favor of a single address recipient - the “owner” of the meToken.

The owner of the meToken is provided with no special administrative privileges, which allows meTokens to remain uniquely trustless - an important feature when considering how meTokens ought to achieve composability with the rest of DeFi.

Ask

9,500 DAI & your help

Funds

meTokens has taken 0 funding to date. It has all been built out of pocket and through generous early contributions from Chris Dixon, CarlFarterson, MetaDreamer, Ven Gist, Darren Mills, Sam Kuhlmann, and the rest of the RaidGuild family.

The requested funds will serve as a bridge to launch the new, ready-for-prime-time version of meTokens. Expenses include:

- Design and branding - proposal from Raid Guild members Lucas, Bingo, & Tom

- Governance, airdrop, & liquidity mining contracts - proposal by Crypto_Unico

- Compensation to additional MetaCartel & RaidGuild volunteer contributors (TBA)

None of this grant will be retained by the core team members. It will be spent immediately to get the product closer to shipping.

Help

We would like to invite any and all community members who are interested in contributing to reach out in the comments below or on discord. meTokens needs to be a community owned protocol and we are happy to reward community members with governance tokens and additional funding in exchange for contributions. Current tasks in the pipeline include:

- Integrating 3Box, Ceramic, theGraph (and building a subgraph)

- Solidity contributions, code review, or audits of the meTokens-core codebase

- UX Design to review or contribute to the figma boards and meTokens-interface codebase

Furthermore, in the event this proposal is passed and meTokens opens a Community Contribution Offering, MetaCartel members will be included in the whitelist of contributors.

Team

-

Chris Robison - Founder, Architect // Twitter

Formerly contributed to Mastercoin, Hoard, OMG Network, and Golem Foundation. Cohort alumni of ODF5 and GitCoin KERNEL II. Spoke at multiple ETHGlobal events, the Ethereum Community Fund, the Enterprise Ethereum Alliance, DevCon and more. -

CarlFarterson - Solidity Dev // Twitter, GitHub

DAO maximalist: auditor of WhalerDAO, KarmaDAO host, lead dev for SaltAndSatoshi, and founder of Web3 Best Practices code review distributed group. Presently contributing as an AMM engineer at Arrary.Finance and firmer technical writer at ConsenSys Diligence. -

Geronimo - Full Stack Web3 Dev

Previously worked as a software engineer at a handful of mobile app startups prior to crypto. Formerly has contributed to Celsius Network, CoinMetro, and CoinList.

First of all, I want to thank you all so much for giving us the opportunity to receive this grant in the first place. It really was a game changer for the project that helped us to operate for many months until we were able to secure our first round of fundraising. I honestly don’t know what state meTokens would be in without the generosity of the community.

First of all, I want to thank you all so much for giving us the opportunity to receive this grant in the first place. It really was a game changer for the project that helped us to operate for many months until we were able to secure our first round of fundraising. I honestly don’t know what state meTokens would be in without the generosity of the community. Second of all, we are (finally) going living very soon™. Our lead solidity dev, Carter, is at MCON this week to conduct a workshop on Wednesday, the 7th at 2pm MT where he will demo the protocol for the first time. Check the side events page to get Carter’s contact info or message me here or on

Second of all, we are (finally) going living very soon™. Our lead solidity dev, Carter, is at MCON this week to conduct a workshop on Wednesday, the 7th at 2pm MT where he will demo the protocol for the first time. Check the side events page to get Carter’s contact info or message me here or on  Lastly, I want to offer to make myself available for anyone in the community to please reach out if they have any questions about the process of receiving a grant and managing it responsibly. I learned some very difficult lessons over the last year+ and if there’s anything I can do to help others build more efficiently and effectively, please do not hesitate to reach out and lmk!

Lastly, I want to offer to make myself available for anyone in the community to please reach out if they have any questions about the process of receiving a grant and managing it responsibly. I learned some very difficult lessons over the last year+ and if there’s anything I can do to help others build more efficiently and effectively, please do not hesitate to reach out and lmk!